Simple Steps to improve credit score

Credit scores are very important to all of us, no matter how young or old we are because we are judged on those scores. People who do not have good credit scores end up paying more for car or house loans because the interest rate given on the loan is dependent on the credit score. A credit score is a three-digit number based on your credit reports. The score determines your worthiness of borrowing money. Simply put – the lender wants to know how well you will do paying back the loan. Of course, there are simple steps to improve credit score.

After my divorce 10 years ago, my credit score wasn’t great. Remember when you used to get credit card offers in the mail every day? My ex-husband loved those! He would use the card and I wouldn’t even know about it until I got a bill in the mail. I would try to pay a bill off and as soon as I did there would be another to take its place. During the divorce, the court split our expenses and the house payment was assigned to him to pay and I paid all the other bills. Our divorce took 8 months to finalize and he didn’t make that payment even one time. Now you know why my credit score had taken a nosedive.

Once the divorce was final, I set a plan in place to pay the debt off and improve my credit score. It’s important to say here that this was not done over-night, over a month, or even a year. But if you are consistent and diligent you can greatly improve it within a year. It actually took me 8 years to pay off the debt from my marriage but much less than that to fix my credit.

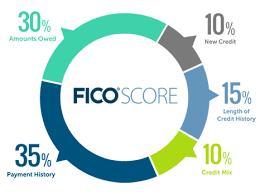

The three reporting agencies are Experian, TransUnion, and Equifax. You have probably heard of a FICO score and a VantageScore. While FICO is the one most widely used by credit lenders, VantageScore has about 10% of the market for credit scores used by the industry but it was only introduced in 2013.

Credit scores are based on these points:

-

- The percentage of payments made on-time.

- The average age of open credit lines.

- Open credit card utilization.

- Total number of open accounts

- A number of derogatory marks.

- A number of hard credit inquiries.

The first step towards improving your credit score is to set up a free account with CreditKarma.com. This is the best tool I have found to see all of my open and closed accounts, see any payment issues, review my credit card utilization, and see any questionable issues such as late payments, derogatory remarks, or credit inquiries.

They also give suggestions for credit cards and loans that may be better than what you currently have. I have also used information in this site to close accounts I no longer want to keep open. Once you have your free CreditKarma account setup – you’re ready to begin improving that credit score!

- Review your personal information such as names, addresses, and employment history. If you have been through a divorce and you have joint accounts – be sure to close all of these accounts. You can always get an account in just your name.

- Review all the accounts that are open for accuracy.

- Does the credit limit and balance look correct?

- Are there any missing payments?

- Check the credit card utilization. You may be asking what is credit card utilization…that is how much of the credit limit are you using. Example: Your credit limit is $2,000 and your balance is $1,800 – you are using 90% of your credit limit so that is your utilization for that card. If you are using more than 50% and you are in good standing with the credit card company you might call and ask for them to increase your limit. This is not so you can charge more to the card! This is to improve your credit card utilization. Any card with greater than 30% utilization could have a negative effect on your credit.

- Look at any loans you may have, could you improve your rate? Could you consolidating your loans at a lower rate? If you can, but then still pay the same amount you were paying on the other loans – you will pay off your debt much faster. This can reduce your debt to income ratio which will always improve your credit worthiness.

- Once you’ve reviewed the above items answer these questions:

- Are there any late payments? Can those accounts be closed? I’m still trying to determine if closing an account that you had a late payment on will improve your credit score. If you have the answer to this question – please comment! I would love to know this.

- Be careful closing accounts that have are among your oldest because this could lower your credit score. They do use the average age of your accounts in the credit score calculation.

- Look at the hard credit inquiries. Something my daughter and I experienced while she was looking at cars was a car dealership recording multiple hard credit inquiries. We believe that the unnamed dealership was upset because she looked at buying a car from them but changed her mind. At that time it appears they checked her credit 5 times that week. This did affect her credit because she was only 23 at the time and didn’t have much credit history. Luckily the hard credit inquires don’t affect your credit if you have good credit already unless you have over 10 inquires. These hard credit inquires drop off your credit history after two years. When creditors see multiple hard credit inquires it can cause some concern but it is up to each lender how much that plays into their decision to give the loan.

- Are there any late payments? Can those accounts be closed? I’m still trying to determine if closing an account that you had a late payment on will improve your credit score. If you have the answer to this question – please comment! I would love to know this.

- Anything that looks incorrect – you can work with the credit reporting agencies by writing a letter to dispute any error. The letter should include exactly what you are disputing, the information provider of the incorrect information, and your contact information. Send the letter to the credit agency reporting the error. You should also send a copy to Consumer Financial Protection Bureau. More on that here.

None of these items are difficult and can all be done within minutes. Be sure to set up alerts on Credit Karma so you will receive an email when anything changes with your credit score. This is very helpful because then if there is a hard credit inquiry you will know right away. As time passes and you’re making your payments on time the negative credit information will fall off your report. If you had bad credit habits – you can change those habits and improve your credit score over time. There is no better time than the present to work on this. Once I got on track I have been able to maintain a score of 780. Considering that 10 years ago it was 635, this is proof it can be done.

Do you have a story to tell about your credit? Have you had any credit situations to overcome? If so – I’d love to get your take on improving your credit score. I am always looking for suggestions because people ask me how I did it and I’m happy to share my experience.